The #1 Cyber Security Mistake Over 90% of Accounting Firms Are Making

The IRS has mandated that all tax & accounting firms have in place a data security plan to document the measures being taken to protect taxpayer data.

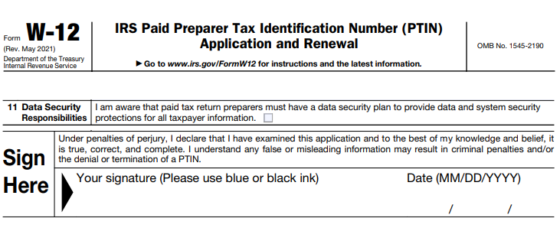

On PTIN Renewal IRS Form W-12 –

11 Data Security Responsibilities: I am aware that paid tax return preparers must have a data security plan to provide data and system security protections for all taxpayer information.”

“Under penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it is true, correct, and complete. I understand any false or misleading information may result in criminal penalties and/or the denial or termination of a PTIN.”

The IRS is making a big deal about data security, and rightfully so. With the increased amount of hackers trying to access taxpayer data, it’s time for all accountants to make sure their systems are fully protected.

The data security plan is a great way to outline and get awareness to what your firm currently has in place, and where it might be lacking.

If you need help getting started with a data security plan, Tech 4 Accountants has a free template you can download and modify as it fits your firm

Free Download To Protect Your Firm